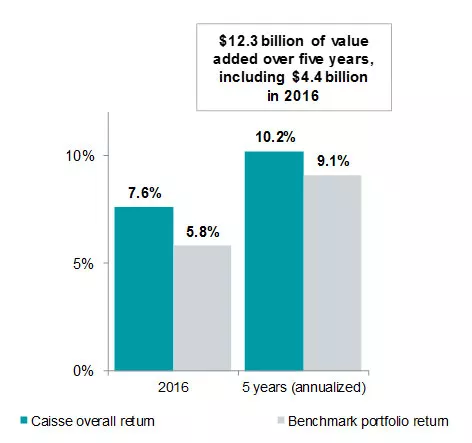

La Caisse posts a 10.2% five-year annualized return

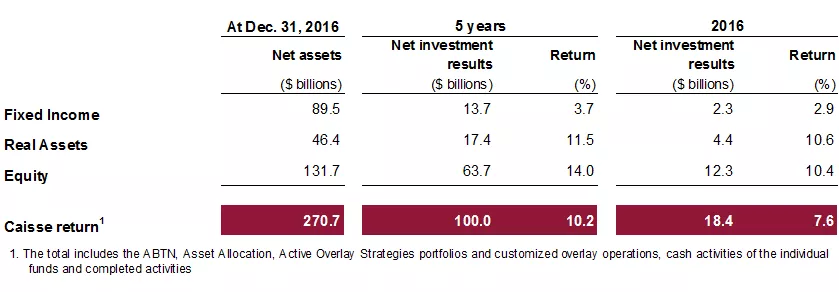

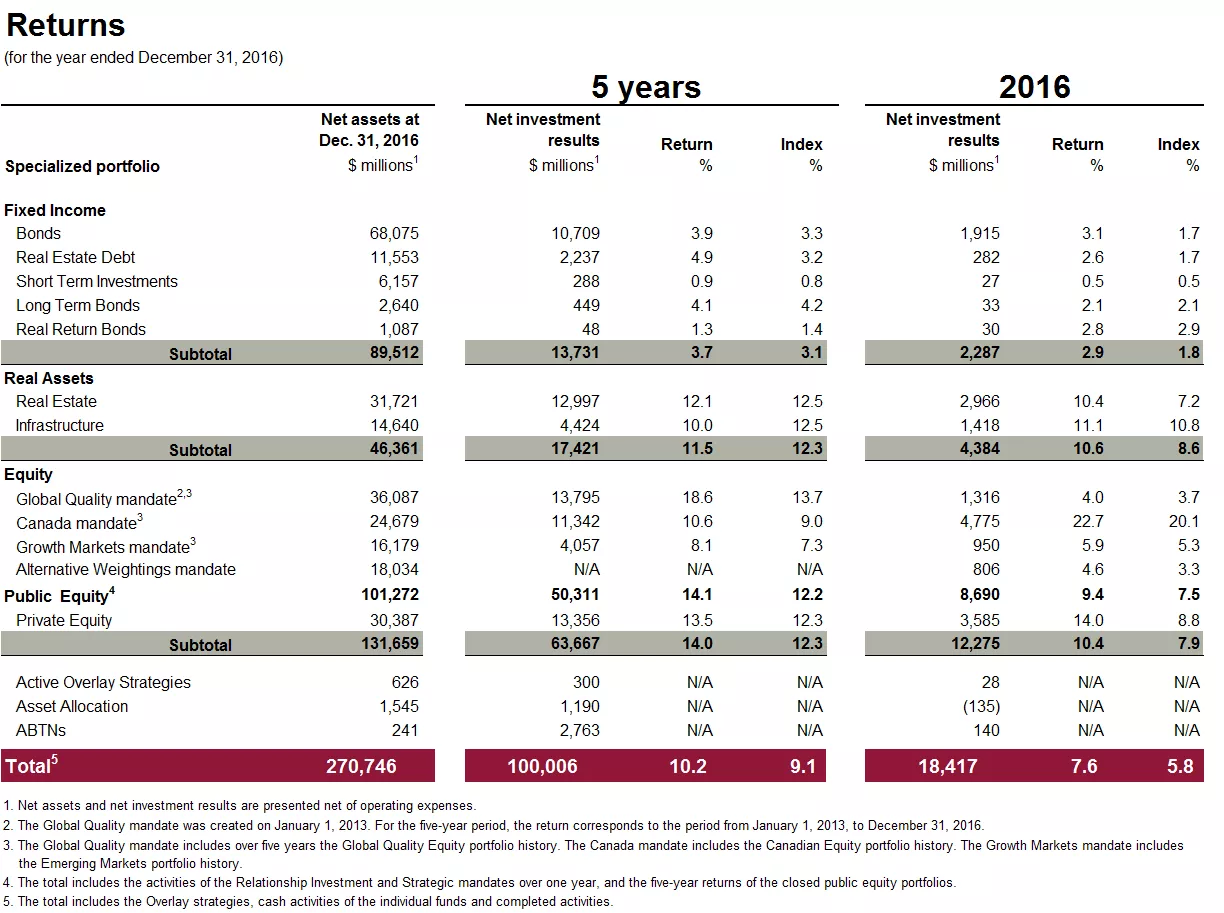

Caisse de dépôt et placement du Québec today released its financial results for the year ended December 31, 2016. The annualized weighted average return on its clients’ funds reached 10.2% over five years and 7.6% in 2016.

Net assets totalled $270.7 billion, increasing by $111.7 billion over five years, with net investment results of $100 billion and $11.7 billion in net deposits from its clients. In 2016, net investment results reached $18.4 billion and net deposits totalled $4.3 billion.

Over five years, the difference between la Caisse’s return and that of its benchmark portfolio represents more than $12.3 billion of value added for its clients. In 2016, the difference was equivalent to $4.4 billion of value added.

“Our strategy, focused on rigorous asset selection, continues to deliver solid results,” said Michael Sabia, President and Chief Executive Officer of la Caisse. “Over five years, despite substantially different market conditions from year to year, we generated an annualized return of 10.2%.”

falsefalse

“On the economic front, the fundamental issue remains the same: slow global growth, exacerbated by low business investment. At the same time, there are also significant geopolitical risks. Given the relative complacency of markets, we need to adopt a prudent approach.”

“However, taking a prudent approach does not mean inaction, because there are opportunities to be seized in this environment. Through our global exposure, our presence in Québec, and the rigour of our analyses and processes, we’re well-positioned to seize the best opportunities in the world and face any headwinds,” added Mr. Sabia.

falsefalse

Over five years, the main clients’ returns stood between 11.4% and 8.7%, aligned with their investment policies, which differ depending on their risk tolerance. For 2016, their returns were between 8.2% and 6.3%.

HIGHLIGHTS OF THE ACCOMPLISHMENTS

The strategy that la Caisse has been implementing for seven years focuses on an absolute-return management approach in order to select the highest-quality securities and assets, based on fundamental analysis. La Caisse’s strategy also aims to enhance its exposure to global markets and strengthen its impact in Québec. The result is a well-diversified portfolio that generates value beyond the markets and brings long-term stability.

Bonds: performance in corporate credit stands out

The Bonds portfolio, totalling more than $68 billion, posted a 3.9% return over five years, higher than that of its benchmark. The difference is equivalent to value added of $1.6 billion. Securities of public and private companies and the active management of credit spreads in particular contributed to the portfolio’s return.

In 2016, despite an increase in interest rates at year-end, the portfolio posted a 3.1% return. It benefited from continued investment in growth market debt and from the solid performance of corporate debt, particularly in the industrial sector.

Public equity: sustained returns over five years and the Canadian market rebound in 2016

Over the five-year period, the annualized return of the entire Public Equity portfolio reached 14.1%. In addition to demonstrating solid market growth over the period, the return exceeded that of the benchmark, reflecting the portfolio’s broad diversification, its focus on quality securities and well-selected partners in growth markets. The Global Quality, Canada and Growth Markets mandates generated, respectively, annualized returns of 18.6%, 10.6% and 8.1%, creating $5.8 billion of value added.

For 2016, the 4.0% return on the Global Quality mandate reflects the depreciation of international currencies against the Canadian dollar. The mandate continued to be much less volatile than the market. The Canada mandate, with a 22.7% return, benefited from a robust Canadian market, driven by the recovery in oil and commodity prices and the financial sector’s solid performance, particularly in the second half of the year.

Less-liquid assets: globalization well underway and a solid performance

The three portfolios of less-liquid assets – Real Estate, Infrastructure and Private Equity – posted a 12.3% annualized return over five years, demonstrating solid and stable results over time. During this period, investments reached more than $60.1 billion. In 2016, $2.4 billion were invested in growth markets, including $1.3 billion in India, where growth prospects are favourable and structural reforms are well underway. The less-liquid asset portfolios are central to la Caisse’s globalization strategy, with their exposure outside Canada today reaching 70%.

More specifically, in Real Estate, Ivanhoé Cambridge invested $5.8 billion and its geographic and sector-based diversification strategy continued to perform. In the United States, the Caisse subsidiary acquired the remaining interests in 330 Hudson Street and 1211 Avenue of the Americas in New York and completed construction of the River Point office tower in Chicago. In the residential sector, the strategy in cities such as London, San Francisco and New York and the steady demand for residential rental properties generated solid returns. In Europe, Ivanhoé Cambridge and its partner TPG also completed the sale of P3 Logistic Parks, one of the largest real estate transactions on the continent in 2016. In Asia-Pacific, Ivanhoé Cambridge acquired an interest in the company LOGOS, its investment partner in the logistics sector, alongside which it continues to invest in Shanghai, Singapore and Melbourne.

In Private Equity, la Caisse invested $7.8 billion over the past year, in well-diversified markets and industries. Through the transactions carried out in 2016, la Caisse developed strategic partnerships with founders, families of entrepreneurs and operators that share its long-term vision. In the United States, it acquired a significant ownership stake in AlixPartners, a global advisory firm. La Caisse also acquired a 44% interest in the Australian insurance company Greenstone and invested in the European company Eurofins, a world leader in analytical laboratory testing of food, environmental and pharmaceutical products. In India, la Caisse became a partner of Edelweiss, a leader in stressed assets and specialized corporate credit. It also invested in TVS Logistics Services, an Indian multinational provider of third-party logistics services.

In Infrastructure, la Caisse partnered with DP World, one of the world’s largest port operators, to create a $5-billion investment platform intended for ports and terminals globally. The platform, in which la Caisse holds a 45% share, includes two Canadian container terminals located in Vancouver and Prince Rupert. In India’s energy sector, la Caisse acquired a 21% interest in Azure Power Global, one of India’s largest solar power producers. Over the year, la Caisse also strengthened its long-standing partnership with Australia’s Plenary Group by acquiring a 20% interest in the company. Together, la Caisse and Plenary Group have already invested in seven social infrastructure projects in Australia.

Impact in Québec: a focus on the private sector

In Québec, la Caisse focuses on the private sector, which drives economic growth. La Caisse’s strategy is built around three main priorities: growth and globalization, impactful projects, and innovation and the next generation.

Growth and globalization

In 2016, la Caisse worked closely with Groupe Marcelle’s management team when it acquired Lise Watier Cosmétiques to create the leading Canadian company in the beauty industry. It also supported Moment Factory’s creation of a new entity dedicated to permanent multimedia infrastructure projects, and worked with Lasik MD during an acquisition in the U.S. market. Furthermore, by providing Fix Auto with access to its networks, la Caisse facilitated Fix Auto’s expansion into China and Australia where the company now has around 100 body shops.

Impactful projects

In spring 2016, CDPQ Infra, a subsidiary of la Caisse, announced its integrated, electric public transit network project to link downtown Montréal, the South Shore, the West Island, the North Shore and the airport. Since then, several major steps have been completed on the Réseau électrique métropolitain (REM) project, with construction scheduled to begin in 2017.

In real estate, Ivanhoé Cambridge and its partner Claridge announced their intention to invest $100 million in real estate projects in the Greater Montréal area. La Caisse’s real estate subsidiary also continued with various construction and revitalization projects in Québec, including those underway at Carrefour de l’Estrie in Sherbrooke, Maison Manuvie and Fairmont The Queen Elizabeth hotel in Montréal, as well as at Place Ste-Foy and Quartier QB in Québec City.

Innovation and the next generation

In the new media industry, la Caisse made investments in Triotech, which designs, manufactures and markets rides based on a multi-sensorial experience; in Felix & Paul Studios, specialized in the creation of cinematic virtual reality experiences; and in Stingray, a leading multi-platform musical services provider. La Caisse also invested in Hopper, ranked among the top 10 mobile applications in the travel industry. Within the electric ecosystem, la Caisse reinvested in AddÉnergie to support the company’s deployment plan, aimed at adding 8,000 new charging stations across Canada in the next five years.

In the past five years, la Caisse’s new investments and commitments in Québec reached $13.7 billion, with $2.5 billion in 2016. These figures do not include the investment in Bombardier Transportation and the $3.1-billion planned commitment by la Caisse to carry out the REM project. As at December 31, Caisse assets in Québec totalled $58.8 billion, of which $36.9 billion were in the private sector, which is an increase in private assets compared to 2015.

FINANCIAL REPORTING

La Caisse’s operating expenses, including external management fees, totalled $501 million in 2016. The ratio of expenses was 20.0 cents per $100 of average net assets, a level that compares favourably to that of its industry.

The credit rating agencies reaffirmed la Caisse’s investment-grade ratings with a stable outlook, namely AAA (DBRS), AAA (S&P) et Aaa (Moody’s).

ABOUT CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC

Caisse de dépôt et placement du Québec (CDPQ) is a long-term institutional investor that manages funds primarily for public and parapublic pension and insurance plans. As at December 31, 2016, it held $270.7 billion in net assets. As one of Canada's leading institutional fund managers, CDPQ invests globally in major financial markets, private equity, infrastructure and real estate. For more information, visit cdpq.com, follow us on Twitter @LaCDPQ or consult our Facebook or LinkedIn pages.

- 30 -