The Caisse de dépôt et placement du Québec repositions its Real Estate group to focus on core businesses

The President and Chief Executive Officer of the Caisse de dépôt et placement du Québec, Michael Sabia, today announced changes aimed at repositioning the Caisse’s Real Estate group to focus on its core businesses. These adjustments are part of the action plan launched by the Caisse last April to concentrate on key operations and streamline its structure.

The organizational and strategic changes include:

- integration of the Cadim division into the SITQ subsidiary;

- cessation of investments in the mezzanine and other subordinated loans sector.

Mr. Sabia also announced the appointment of René Tremblay to the position of Executive Vice-President, Real Estate, and President of the Caisse’s Real Estate group.

“These changes were necessary to ensure the success of the Real Estate group in the context of a weakened global real estate market, especially in the United States. They will allow us to focus our efforts in the businesses that have produced excellent long-term returns: 11.9% over 5 years and 12.1% over 10 years,” said Mr. Sabia.

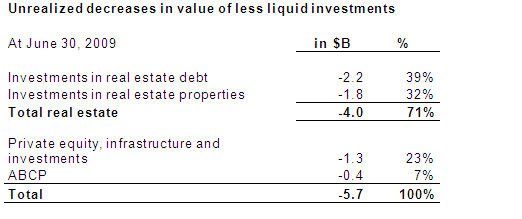

In 2009, prevailing global market conditions significantly contributed to unrealized declines in value of the Caisse’s less liquid investments. At June 30, decreases in the value of real estate investments amounted to $4.0 billion, while those of other less liquid investments totalled $1.7 billion. The overall decline of $5.7 billion offset the 5% return that the Caisse earned during the semester.

Continued implementation of the Caisse’s action plan

With the repositioning of its Real Estate group, the Caisse has taken another step forward in its action plan. Notably, since April, it has:

- implemented an accelerated work plan aimed at reinforcing and improving its risk management processes;

- ceased certain asset allocation and hedge fund operations, and regrouped its investment operations in liquid markets in the Fixed Income and Currencies and Equity Markets sectors;

- recruited a high-level asset manager, Roland Lescure, as Chief Investment Officer.

In addition, noting the improvements made by the Caisse in the past few months, on July 30 the credit rating agency Standard & Poor’s reaffirmed the Caisse’s AAA rating with a “stable outlook.” In June, the rating agency Dominion Bond Rating Services (DBRS) confirmed the Caisse’s AAA rating.

CHANGES IN THE REAL ESTATE GROUP’S STRATEGY AND STRUCTURE

Integration of Cadim into SITQ and cessation of investments in the mezzanine and other subordinated loans sector

The Caisse announced the integration of the Cadim division, which invests in multi-residential properties and hotels, into the SITQ subsidiary, a world leader in the office buildings and business parks sector.

“Cadim and SITQ carry out their operations in complementary sectors,” explained René Tremblay, Executive Vice-President, Real Estate, and President of the Caisse’s Real Estate group. “Our goal in this reorganization was to streamline the structure of the Real Estate group and to give it the flexibility required to take advantage of investment opportunities and better manage risk. Furthermore, with SITQ’s solid expertise in operational management, we will be able to more proactively manage our investments.”

Until 2008, the Cadim division was responsible for investments in subordinated loans, including mezzanine loans, especially in the U.S. market. (See Appendix I – Mezzanine Loan.)

“The investment model adopted by Cadim was aimed at seeking higher returns through increased risk. In the real estate financing sector, Cadim’s strategy was based on forecasts calling for marked growth of the subordinated loans market,” stated Mr. Sabia. “The financial crisis, however, eroded market conditions needed to underpin that strategy, namely in the United States.”

In 2008, all of the Real Estate group’s investment activities in real estate debt, including those of Cadim, were assigned to a new subsidiary, Otéra Capital. The Caisse announced today that this subsidiary will now focus on its core business: first mortgage loans. This means it will cease to invest in the mezzanine and other subordinated loans sector.

Appointments

Changes to the Real Estate group structure include the following appointments:

René Tremblay is appointed as Executive Vice-President, Real Estate, and President of the Caisse’s Real Estate group. In this position, he will oversee the development of investment strategies and co-ordination of the real estate subsidiaries’ activities. He will also sit on the Caisse’s Executive Committee and chair the boards of directors of SITQ, Ivanhoe Cambridge and Otéra Capital.

“I am very pleased that René Tremblay agreed to join the Caisse’s management team. Like his predecessor, Fernand Perreault, René has tremendous experience in real estate operations and has distinguished himself by delivering excellent long-term returns. He is the ideal leader to meet the Caisse’s challenges in the real estate sector.”

Karen Laflamme is appointed Senior Vice-President, Real Estate. She will support Mr. Tremblay in the integrated management of the Real Estate group’s activities.

André Charest is appointed Senior Vice-President, Risk Management – Real Estate. This appointment is part of the implementation of the Caisse’s action plan in risk management. Mr. Charest will report directly to the Chief Risk Officer, Susan Kudzman.

MARKET ENVIRONMENT AND THE CAISSE’S SITUATION

Precarious economic and financial conditions

Overall, since the beginning of 2009, the Caisse’s less liquid investments – those in real estate, private equity and asset-backed commercial paper (ABCP) – have had declines in value under precarious economic and financial conditions. Real estate investments in particular have felt the effects of a weakened global market, namely difficulties in the U.S. commercial real estate sector. (See Appendix II – Real Estate Market Conditions.)

It is worthwhile to note that under the accounting standards applicable to investment companies, the Caisse has to adjust the book value of its investments to their fair market value (mark-to-market). Since 2006, the Caisse’s practice has been to assess its less liquid investments on a semi-annual basis. Decreases in value are essentially the reflection of changes experienced in the market conditions of less liquid investments during the first half of 2009. (See Appendix III – Valuation of Investments.) It cannot be excluded, however, that some of these decreases in value will materialize.

Neutral performance, despite unrealized decreases in value

“Considering the scale of decreases in value we have accounted for, primarily in real estate, and the fact that the Caisse’s returns are of great importance to Quebecers, we felt it was the right time to take stock of the situation,” stated Mr. Sabia.

At June 30, 2009, the Caisse posted a neutral performance despite unrealized decreases in value totalling $5.7 billion. Net investment results, as well as an increase in the value of liquid investments, have offset the decreases in value of less liquid investments.

As part of its assessments to June 30, 2009, the Caisse used the same valuation techniques as in previous years – external appraisers and valuation specialists independent from the Caisse for less liquid investments.

“We expect market conditions for less liquid investments to remain difficult in the mid-term, given the continuing weakness of the global economy. That said, it must be kept in mind that overall, our less liquid investments are made up of quality assets from which we continue to derive regular income such as rental revenues from our properties,” Mr. Sabia said.

Additionnal content provided in Appendixes.

APPENDIX I – Mezzanine Loan (PDF)

APPENDIX II– Real Estate Market (PDF)

APPENDIX III– Valuation of Invetments (PDF)

ABOUT THE CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC

The Caisse de dépôt et placement du Québec is a financial institution that manages funds primarily for public and private pension and insurance plans. At December 31, 2008, it held $120.1 billion of net assets. As one of the leading institutional fund managers in Canada, the Caisse invests in the main financial markets as well as in private equity and real estate. For more information: www.cdpq.com.