Update as at June 30, 2015 - Four-year annualized return of 10.2%, six-month return of 5.9%

Caisse de dépôt et placement du Québec (CDPQ) presented today an update of its performance as at June 30, 2015. At the end of the first six months of 2015, the four-year average annual return was 10.2%, generating net investment results of $75 billion for this period. For the first six months of the year, the weighted average return on clients’ funds stood at 5.9%. Net assets totalled $240.8 billion as at June 30, 2015.

“Over a four-year reference period, la Caisse has achieved solid results, exceeding both our clients’ long-term needs and our benchmark indices,” said Michael Sabia, President and Chief Executive Officer. “Like all investors, la Caisse has certainly benefited from bull markets that have been fueled by stimulative monetary policies. But beyond market growth, our teams have identified the right strategies and they have deployed them rigorously.

“Continuing to do well will be even more challenging in the months and years to come. Against a backdrop of high asset valuations and growing economic and geopolitical risks, we will need to be even more rigorous in choosing our investments. We will need to raise our game and to innovate to find the most attractive investment opportunities. This is the objective of all of our investment teams.”

Over four years, the returns of CDPQ’s eight largest clients ranged from 9.5% to 11.0%. For the first six months of 2015, they ranged from 5.1% to 6.8%.

INVESTMENT HIGHLIGHTS

In the first six months of the year, CDPQ continued to implement its investment strategy by focusing on two priorities: globalization and innovation. This resulted in several new investments, deployment of its teams around the world, and implementation of innovative initiatives in entrepreneurship and in infrastructure.

In the global arena, CDPQ acquired an interest in Eurostar, the pre-eminent high-speed rail operator in Europe, and in Southern Star Central Corporation, a natural gas pipeline operator in the United States. It also invested in the mobile telecommunications sector in the United Kingdom, in addition to acquiring stakes in SterlingBackcheck, one of the world’s largest background screening companies, and in SPIE, a European engineering leader.

Ivanhoé Cambridge completed several real estate transactions internationally, including its first direct investment in Australia, with the acquisition of an interest in an office building in Sydney, and two investments in Shanghai. It also acquired properties in New York, London, Chicago and San Francisco, and increased its interest in the European real estate company Gecina.

CDPQ also innovated by proposing a unique model to finance and carry out public infrastructure projects with the establishment of CDPQ Infra. This wholly-owned subsidiary will act as the owner-operator of certain infrastructure projects globally. Two projects in Québec are already under consideration: a public transit system on Montréal’s new Champlain Bridge and a public transit system linking downtown Montréal to the Montréal-Trudeau International Airport and the West Island.

To give new impetus to the most promising Québec businesses and to encourage them to innovate and expand globally, CDPQ announced the creation of Espace CDPQ, a lasting contribution to mark CDPQ’s 50th anniversary. Located in Place Ville Marie, this entrepreneurial ecosystem will bring together a number of key players, including WeWork, the École d’entrepreneurship de Beauce and Anges Québec. It will be structured around three pillars: collaboration, coaching and financing.

CDPQ also invested in Québec companies such as Cirque du Soleil and Logistec. In addition, it financed Québec City’s Jean Lesage International Airport and the acquisition of Montreal Gateway Terminals Partnership. Ivanhoé Cambridge announced the modernization of the Laurier Québec shopping centre and the development of an observatory atop Place Ville Marie.

PERFORMANCE HIGHLIGHTS

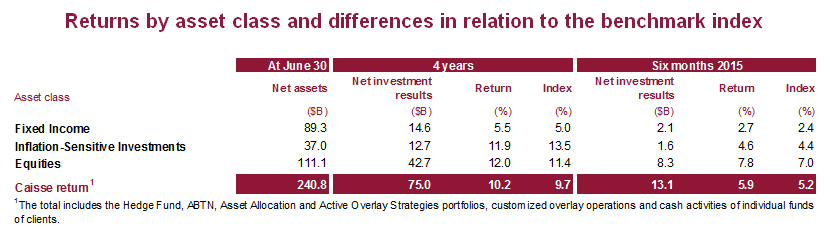

As at June 30, 2015, clients’ net assets totalled $240.8 billion, up $14.9 billion from $225.9 billion at December 31, 2014. This growth is attributable to net investment results of $13.1 billion, in addition to net deposits of $1.8 billion.

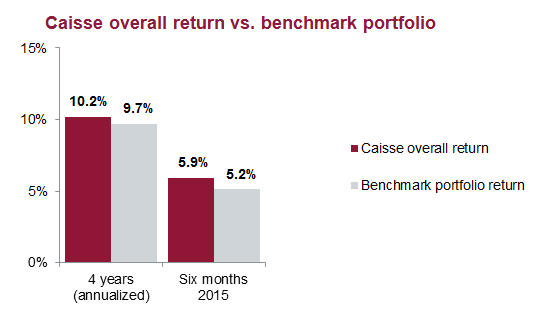

Over four years, CDPQ’s annualized return was 10.2%. Compared to that of its benchmark portfolio at 9.7%, this performance generated $4.1 billion in value added.

All portfolios contributed positively to the four-year annualized return. Fixed Income generated a return of 5.5%, or 0.5% above its index. Inflation-Sensitive Investments generated a return of 11.9%, or 1.6% less than its index. The Equity asset class exceeded the benchmark index by 0.6%, reaching 12.0%. These strong results are attributable to several factors, including private debt and credit activity, real estate debt activity, the repositioning of the Canadian Equity portfolio toward absolute-return management, the strategy aimed at selecting quality securities, and the performance of our Private Equity, Real Estate and Infrastructure portfolios. Overall, the strategy enabled CDPQ to generate solid investments with well-managed risk.

For the six-month period ended June 30, 2015, CDPQ recorded a 5.9% return and exceeded its benchmark portfolio by 0.7%, generating $1.7 billion in value added.

Each asset class generated a six-month return above its index. Equities returned 7.8%, with net investment results of $8.3 billion, approximately half of which comes from the Global Quality Equity and Private Equity portfolios. With a 2.7% return, Fixed Income generated net investment results of $2.1 billion. Inflation-Sensitive Investments recorded a 4.6% return, generating net investment results of $1.6 billion.

ASSET ALLOCATION

As at June 30, 2015, the Equity asset class represented 46% of the overall portfolio, while Fixed Income and Inflation-Sensitive Investments represented 37% and 15%, respectively.

RISK MANAGEMENT AND FINANCIAL STABILITY

CDPQ’s available liquidity remains robust and ensures potential commitments can be met and that contingencies are covered.

In addition, CDPQ’s exposure to market, credit, counterparty and liquidity risks remained substantially unchanged since December 31, 2014.

OPERATING EXPENSES

Operating expenses and external management fees are in line with forecasts and are at a similar level as in 2014, at 16 cents per $100 of average net assets.

ABOUT CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC

Caisse de dépôt et placement du Québec (CDPQ) is a long-term institutional investor that manages funds primarily for public and parapublic pension and insurance plans. As at June 30, 2015, it held $240.8 billion in net assets. As one of Canada’s leading institutional fund managers, CDPQ, which marks its 50th anniversary this year, invests globally in major financial markets, private equity, infrastructure and real estate. For more information: www.cdpq.com.

- 30 -