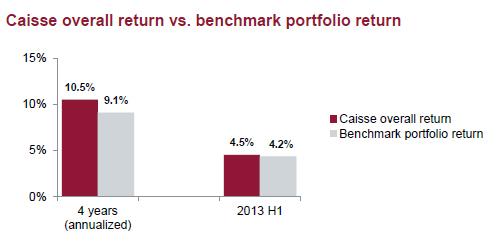

Update as at June 30, 2013, 10.5% annualized four-year return, 4.5% six-month return

The Caisse de dépôt et placement du Québec provided an update today on its performance as at June 30, 2013. At the end of this period, the average annual return over four years was 10.5%, generating net investment results of $58.5 billion. For the first six months of 2013, the weighted average return on depositors’ funds was 4.5%. Net assets grew to $185.9 billion, up $9.7 billion from $176.2 billion as at December 31, 2012.

Over the four-year and six-month periods ended June 30, 2013, the Caisse outperformed its benchmark portfolio.

“Two trends are shaping the investment environment,” said Michael Sabia, President and Chief Executive Officer of the Caisse. “First, the global economy is showing signs of returning to greater “normalcy” as the United States enters a more solid growth phase and the Chinese economy slows, but to a pace that is more sustainable over the long term. However, monetary policies continue to drive the value of many asset classes higher. In this environment, an investor like the Caisse needs to be very selective when it deploys capital.

“Accordingly, in the first six months, we made targeted real estate investments in the United States and successfully launched our absolute-return Global Quality Equity portfolio. This portfolio will be an increasingly important component of our strategy in the years to come.

“Over all, we reported a 4.5% return for the first six months of 2013,” Mr. Sabia added. “As we have said repeatedly, in our business it’s the long term that counts. Over a four-year period, we have delivered a very solid 10.5% return, outperforming our benchmark portfolio and exceeding our depositors’ long-term needs.”

UPDATE ON OUR ACHIEVEMENTS

Since early 2013, the Caisse has continued to deploy its strategic plan in Québec and elsewhere in the world. The main components are as follows:

New investment strategy implemented

- Launch of the Global Quality Equity portfolio with assets of close to $9.5 billion as at June 30, 2013;

- Investment of $1.2 billion under the Private Equity relationship-investing mandate as at June 30, 2013;

- Investment of $4.2 billion in the Real Estate, Private Equity and Infrastructure portfolios, including $500 million in the Invenergy wind farm portfolio (11 projects in the United States and two projects in Canada, including the Le Plateau wind farm in Gaspésie).

Presence in Québec

$1.5 billion of new commitments and investments, including:

- Creation of the Sodémex Développement fund to support the growth of Québec natural resources companies in the development phase ($250 million);

- Launch of phase II of the Capital Croissance PME fund to support the development and growth of small businesses throughout Québec, in partnership with Desjardins Group ($230 million);

- Contribution to the financing of a Vancouver acquisition by Cogeco Cable ($50 million);

- Involvement in the financing of the Vents du Kempt Wind Power Project in the regional county municipality of Matapédia, Québec ($50 million).

Growth of activities in the real estate sector

- Acquisition, in partnership, of a portfolio of 27 multiresidential complexes in the United States (US$1.5 billion);

- Acquisition, in partnership, of the Woolgate Exchange office building in London ($400 million);

- Acquisition of Wells Fargo Center in Seattle (US$390 million);

- Acquisition of AIMCo’s 50% stake in Place Ville Marie ($400 million), which will initiate a plan to revitalize downtown Montréal;

- Acquisition of a 50% interest in the Carrefour de l’Estrie shopping centre (more than $175 million).

PERFORMANCE HIGHLIGHTS

“The first six months of 2013 were marked by rising interest rates and diverging stock market performances, which reflect in part differing economic situations,” pointed out Roland Lescure, Executive Vice-President and Chief Investment Officer. “In the United States, the stock market performed very well, reflecting the renewed strength of the economy. Emerging markets recorded a significant decline of almost 5%, as a result of rising interest rates and disappointing economic performances. With a six-month return of about -1%, the Canadian market reflected the less favourable outlook for emerging market economies and lower prices for certain commodities.”

NET INVESTMENT RESULTS

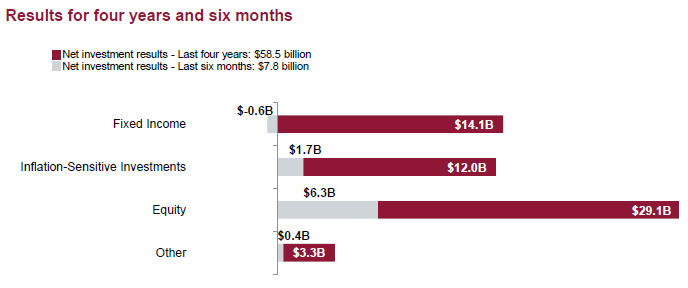

Over a four-year period, all asset classes contributed significantly to the net investment results of $58.5 billion: $29.1 billion for Equity, $14.1 billion for Fixed Income and $12.0 billion for Inflation-Sensitive Investments. In the first half of 2013, net investment results totalled $7.8 billion, and depositors made a net contribution of $1.9 billion. Net investment results come mainly from the Equity portfolios, which generated $6.3 billion of the $7.8 billion. The Inflation-Sensitive Investment portfolios returned $1.7 billion. Rising interest rates caused the Fixed Income portfolios to return $-0.6 billion. Even so, this asset class outperformed its benchmark index.

RETURNS AS AT JUNE 30, 2013

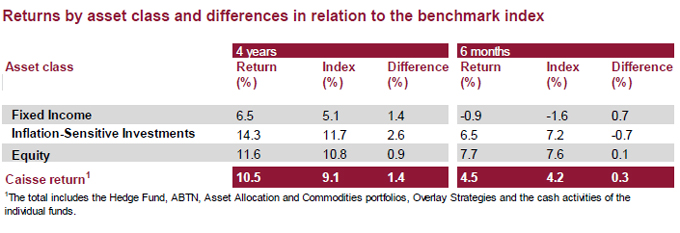

Over four years, the Caisse earned a 10.5% average annual return, versus a 9.1% return for its benchmark portfolio. All the asset classes outperformed their benchmark indexes. The 1.4% positive difference – due mainly to the Bond, Private Equity, Infrastructure and Real Estate Debt portfolios – represents value added of $7.4 billion. The Caisse recorded a 4.5% return for the first six months, outperforming its benchmark portfolio.

ASSET ALLOCATION

As at June 30, 2013, the Equity class represented 47% of the overall portfolio. Fixed Income and Inflation-Sensitive Investments represented 35% and 15% of the portfolio, respectively.

RISK MANAGEMENT AND FINANCIAL STABILITY

The Caisse’s available liquidity of $38 billion in its overall portfolio remains robust and ensures that commitments can be met. The portfolio’s overall risk has declined slightly since December 31, 2012, as a result of the shift in focus from the Global Equity portfolio to the less-risky Global Quality Equity portfolio. Credit, counterparty and liquidity risks remained substantially unchanged from their levels as at December 31, 2012.

OPERATING EXPENSES

The amount of operating expenses and external management fees is in line with forecasts and is at the same level as in 2012, at less than 18 cents per $100 of assets under management.

ABOUT THE CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC

The Caisse de dépôt et placement du Québec is a financial institution that manages funds primarily for public and private pension and insurance plans. As at June 30, 2013, it held $185.9 billion in net assets. As one of Canada’s leading institutional fund managers, the Caisse invests in major financial markets, private equity, infrastructure and real estate globally. For more information: www.cdpq.com.

The Caisse has also included with this press release the summer 2013 analysis of the global economic outlook (PDF)

- 30 -